The Mastercard Foundation works with visionary organizations to empower young people in Africa and Indigenous youth in Canada to access meaningful, dignified, and fulfilling work.

We seek to enable 30 million young people across Africa to access dignified and fulfilling work by 2030, with a focus on young women, refugees and displaced persons, and people with disabilities.

In Canada, our goal is for education and employment systems to be transformed to enable 100,000 Indigenous young people to access post-secondary education and transition to meaningful livelihoods by 2030, driving lasting impact in their communities and across Canada.

Tracking towards our commitment

Learn more about the Foundation-

-

M

Youth-in-Work since 2017

-

-

%

of our partners are African-led organizations

-

-

K

Indigenous youth in Canada engaged through EleV

Programs

Through our partners, we support more than 1,100 programs across Africa and in Canada.

Explore our programs

Countries

The Foundation has offices in Kigali, Accra, Nairobi, Kampala, Lagos, Dakar, Addis Ababa, and Toronto. Our work spans almost 40 countries in Africa and coast-to-coast in Canada.

Where we work

Focus Areas

We focus on leading sectors for youth employment, including education, agriculture, and the digital economy.

Learn moreResearch & Learning

Our research amplifies the voices of young people by highlighting their lived experiences and perspectives, particularly those of young women, young people with disabilities, and refugees and displaced persons.

-

Building the Agriinfluencer Network

Agriculture Kenya, Rwanda, Ghana, Senegal, Uganda, Nigeria -

Study on Africa as a Jurisdiction for Domiciliation of Investment Vehicles - Full Report

WAEMU, Kenya, Rwanda, Burkina Faso, Guinea-Bissau, Djibouti, Mozambique, Egypt, Benin, Ghana, Senegal, Zambia, Uganda, Côte d’Ivoire, Sierra Leone, Eritrea, Gambia, Eswatini , Democratic Republic of Congo, Tanzania, Nigeria, Zimbabwe, South Sudan, South Africa, Cameroon, Ethiopia, Niger, Morocco, Malawi, Chad, Syria, Mali, Togo, Somalia -

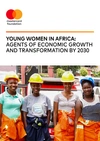

Young Women in Africa: Agents of Economic Growth and Transformation By 2030

WAEMU, Kenya, Nigeria, Rwanda, Uganda, Ethiopia, Ghana, Senegal -

Social Agriculture in the West African Economic and Monetary Union

Agriculture Côte d’Ivoire, Benin

Empowering young voices

Baobab Summit 2025

The Baobab Summit brings together the Mastercard Foundation Program Scholars, Alumni, partners, and other Foundation stakeholders to celebrate the Mastercard Foundation Scholars Program community. This year, our hybrid celebration took place in Kenya and online, allowing everyone to participate.

Learn more

Recognizing Leadership in Education for Indigenous Youth

The Mastercard Foundation announced $235 million in funding to 30 post-secondary institutions and organizations in recognition of their achievements and impact in education for Indigenous youth across Canada.

Learn more

Learn More About Our Programs

Our programming approach is rooted in co-creation and understanding young people's aspirations, needs, and realities. We focus our efforts on areas where they can have the most equitable and sustainable impact at scale.

View all programsLatest from the Mastercard Foundation

-

Rwanda Stakeholders Renew Commitment to Expanding Inclusive Finance for Rural Young Women Entrepreneurs

-

Mastercard Foundation Appoints Alan Jope and Roberta L. Jamieson to its Board of Directors

-

Ananse Center for Design Launches in Lagos to Empower Nigerians and Drive Sustainable Innovation

-

Study Release Kicks off Country-By-Country Engagement to Boost Africa's Untapped Potential as Investment Vehicle Domiciliation Hub

-

Mastercard Foundation Board of Directors Announces Seasoned Technology Leader, Sewit Ahderom, as Next President and CEO

-

African School of Governance’s Pioneer MPA Class Celebrates Matriculation with a Student Dialogue with President Paul Kagame and Former Prime Minister Hailemariam Desalegn

-

Recommendations to Action: Building Resilient Education Systems in Africa

-

Indigenous Youth Are Key Partners in Strengthening Canada’s Security

-

Inclusive Policies Centering and Engaging in Youth Innovation

-

Rural Women: The Overlooked Architects of Africa’s Future

-

From Crisis to Community: Sudan's Young People are Leading with Local Solutions

-

Upskilling Educators to Enhance EdTech Delivery